By Kev Del Castillo

Nigeria: Investment Prospects Overview

Prospects for portfolio investment in Nigeria at the current time are dismal. This conclusion was determined through a comprehensive assessment of the country’s macroeconomic performance, exchange rate stability, and stock market prospects over the next year.

Nigeria: Macroeconomic Performance

The macroeconomic performance of Nigeria has been unstable and insecure for several years. The introduction of the COVID-19 pandemic has reversed the trajectory of what was a modest recovery and has doomed Nigeria’s economic growth prospects, with GDP projected to fall by at least -4.4% this year. The unemployment rate was on the incline prior to the pandemic, reaching a height of over 23% at the close of 2019, per Nigeria’s National Bureau of Statistics. It is projected that unemployment will reach over 34% in 2020. Youth unemployment is even more dire for this nation of one of the world’s youngest and fastest-growing populations. Nigeria’s inflation rate has been volatile in the past several years, regularly hovering in the double-digit range, above the central bank’s target of 6 to 9%. The past 10 months have seen inflation climb without abatement, reaching 12.6% in June. Food inflation is at its highest level since 2018, at 15.2%. Inflation continues to rise due to border closures, trade constraints, and restrictions on access to foreign exchange.

The Federal Ministry of Finance (FMF) and Central Bank of Nigeria (CBN) manipulate fiscal and monetary policy in an attempt to stabilize the economy and achieve certain levels of macroeconomic performance. Prior to COVID-19, Nigeria was struggling to maintain a stable exchange rate and keep monetary policy tight to combat inflation. Interest rates and liquidity were being managed to support the naira, with growth tied to crude oil production. Price stability and management of external reserves have been top priorities. Now in an even more precarious situation due to the crisis, the CBN has announced changes to policy in attempt to ameliorate the negative economic toll. Actions include an extension of the moratorium on CBN intervention funds, reductions in interest rates on CBN intervention provisions, credit support for SMEs/healthcare industry agents, regulatory forbearance, and improved conditions surrounding LDR policy. In terms of fiscal policy, plans relate to relief programs for rural communities and conditional cash transfers (CCTs). The effectiveness of government interventions is criticized as insufficient considering Nigeria’s fiscal and monetary crises. Fiscal deficit is influenced by a lack of economic complexity. The interest rate is the primary monetary policy instrument used by the CBN, with a central rate as the anchor for other rates. Policies are also affected by Nigeria’s high level of openness, with increased susceptibility to fluctuations and cross-border transmission of volatility. The latest monetary policy rate sits at 12.5%, the liquidity ratio at 30%, and the cash reserve ratio at 27%. Nigeria’s debt-to-GDP ratio makes it highly vulnerable to shocks. President Buhari has pledged to converge Nigeria’s failing multiple exchange-rate systems and attain financial support to meet the significant balance of payment needs and budget deficits due to the collapse of the oil market.

Nigeria has the second-largest banking sector in sub-Saharan Africa and was already struggling to rebuild capital levels due to foreign currency shortages and a severe recession that left banks struggling. Reckless lending to the oil sector at the height of the global crude oil market has had a negative effect economically — a pattern that is consistently repeated. Banking has been hurt by vulnerability to the oil market and persistent corruption. The oil industry’s collapse following the pandemic gives the banking sector another injurious puncture. It is impossible to discuss fiscal and monetary policy without noting the role of Nigeria’s dependency on oil. Revenue from the petroleum industry accounts for over 80% of Nigeria’s government’s expenses, flowing through a convoluted system of fiscal federalism via an ostensibly complex revenue allocation formula. Volatility in the price of oil on the global market, internal conflicts, and corruption of public funds defy fiscal health. The marked detriment from the collapse in oil prices and production reverberates across all sectors of Nigeria’s economy. Domestic policy improbity forms weak infrastructure, ubiquitous corruption, and abysmal social protection mechanisms that compound the issue. As the economic performance of Nigeria coincides with that of the global oil market, it is projected to plunge into a severe recession, the damage of which has not occurred since the 1980s.

Nigeria: Exchange Rate Stability

Nigeria’s exchange rate has faced notable volatility over many years, with government attempts to guide it via monetary policy actions. A managed-float is the modus-operandi, and the government has maintained a system of multiple exchange rates to ease pressure on the naira with currency controls previously adopted in order to counter the negative impacts of low oil prices. The exchange rate, like most other economic indicators in Nigeria, has been pointedly linked to oil exports, which make up over 90% of foreign-exchange earnings. This year, oil production and exports are reaching a new low, exposing the nation to substantial risks. Major concerns are rising inflation, rising public debt, worsening terms of trade, and political instability. Terms of trade have been falling for several years, as Nigeria has relied almost exclusively on oil exports, while imports of basic goods have been essential. With the pandemic, exports have collapsed, resulting in imbalances and a move towards grueling current account conditions. An inefficient system of multiple exchange rates complicates Nigeria’s rate stability, and pressures from the IMF and World Bank to come to a unified exchange rate are mounting. Depreciation has been sharp and continues now due to capital flight and curtailed foreign earnings.

In looking at the coefficient of variation, of .18, it is evident that there is a high degree of volatility in Nigeria’s exchange rate, especially when compared to other emerging economies. The trend has been moving towards a weaker exchange rate for a number of years. A forecast is difficult to ascertain, with an ARMA forecast even still useless. See chart 1 for a view of the exchange rate over time. During the COVID-19 pandemic, the CBN has devalued the naira with an adjustment of over 20% thus far. Planned rehabilitation of the exchange rate system leave hopes that confusion will be reduced, and investment encouraged.

Nigeria: Stock Market Prospects

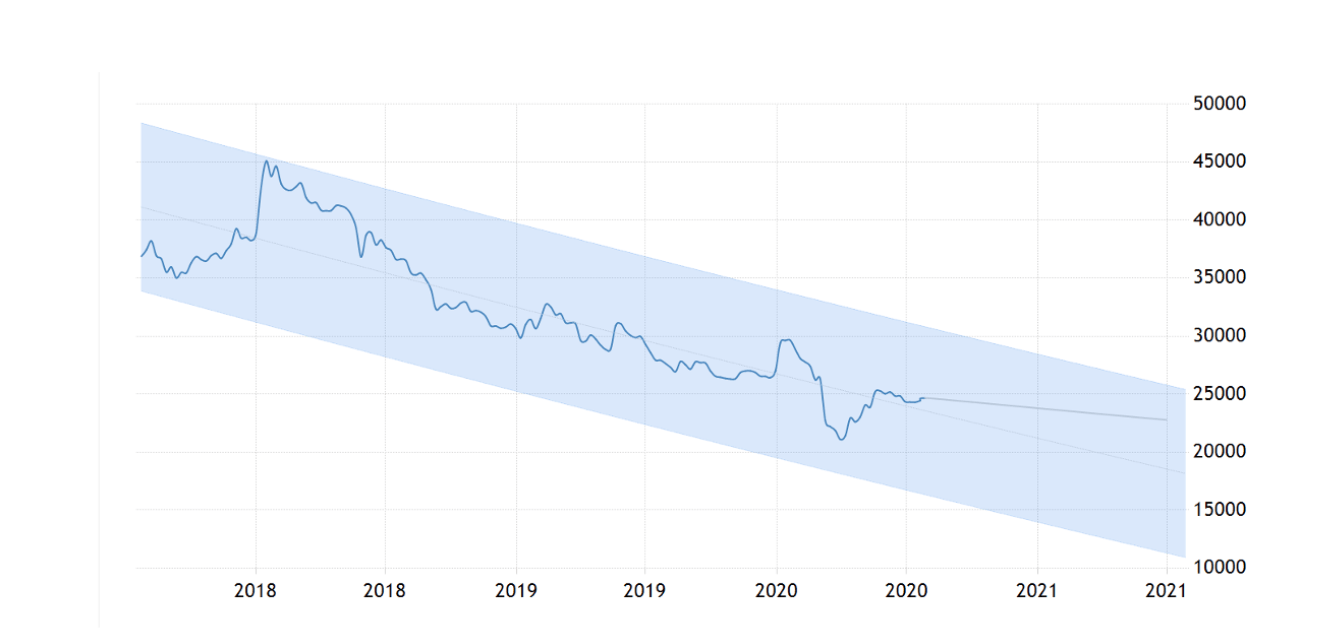

The overall market prospects in Nigeria are not optimistic. Nigeria is a highly import-dependent economy — and one that is not very resilient. The only consistently growing element of Nigeria is the population and poverty percentage. Investments in capital and money markets are consistently a risky activity. Returns for the stock market have been negative and continue to persist as such. See chart 2 for visualization of this expected perpetuation. Risks, always very high, are more precarious than ever and the situation remains volatile in terms of stock market performance. When foreign investors exit, the Nigerian stock market suffers, and there is significant evidence of this occurring. Additionally, the frequency at which currency devaluations occur keep market valuations volatile and at risk of capital erosion. Declining oil prices, coinciding with a plunge of the naira-dollar exchange rate has led to the exit of portfolio investment since 2014. There is evidence of a strong correlation between stock market fluctuation and exchange rate volatility in Nigeria, due to the openness of the economy in that it tends to not restrict capital flows. When exchange-rate suffers, investors flee. Another concern is the lack of accountability of companies that recklessly engage in insider trading and other forms of corruption with impunity. A consensus view, supported by efficiency tests, shows that the Nigerian Stock Exchange is not considered efficient, though improvements in regulatory capacity could potentially be beneficial. These factors, along with very weak investor protection mechanisms leave much to be desired.

Under normal conditions, the Nigerian Stock Exchange does not have high levels of correlation to other major markets such as FTSE, S&P500, or N225, insinuating that it may be an opportunity to diversify investments. High risk and negligible returns, however, make this market unfruitful to pursue under these conditions for the short-term. Due to the pandemic, the correlation between returns in the Nigerian Stock Exchange and these markets is high, reaching 80% correlation levels over the past year (see tables 1 and 2). This year has also seen the worst-performing quarter since 2009, with a more daunting future ahead. Among emerging markets, Nigeria fosters one of the riskiest investments. The Nigerian Stock Exchange lists 161 companies and is regulated by Nigeria’s Security and Exchange Commission. While formerly populated by the oil industry, other prominent sectors now share space on the listing. Chief among these are consumer services, healthcare, agricultural, and financial sectors. Foreign investment has been pursued by the government, having abolished strict legislation around the flow of foreign capital. The best-performing companies on the Stock Exchange YTD, have been Neimeth International Pharmaceuticals (health), Law Union & Rock Insurance (financial), May & Baker (health), and Ekocorp (health). The worst performing companies are breweries, banks, and oil-based companies. There is hope that the government will shift macroeconomic policies to support the agricultural, real estate, and technology sectors. If this change is realized, these industries could be good opportunities for investment, though the situation remains too volatile in the short-term.

Stock market prospects are formidable. With the pandemic eating away at markets around the globe, Nigeria has certainly not been spared. The Nigerian Stock Exchange has experienced its worst year in over a decade, and it is projected to continue falling as recovery is not evident. The foreign reserve, which is rapidly being depleted, and the collapse in crude oil prices mean that the two central attractions for foreign investors are now seemingly evaporated. Prior to the pandemic, foreign portfolio investment made up a strong proportion of capital inflows, but that been falling rapidly since March. The International Monetary Fund projects that foreign portfolio investment for 2020 will crash over $11.4 billion by the end of the year.

Nigeria: Conclusion

As a result of this economic analysis and accompanying research, short-term projections for portfolio investments remain dismal. Macroeconomic performance and key economic indicators are unpredictable or daunting due to reliance on a devastated petroleum industry, a history of government mismanagement, and poor corporate responsibility in a system that lacks social protection mechanisms. Among the concerns are the high level of exchange rate volatility and an existing monetary rate policy that is pending reform. The Nigerian Stock Exchange faces a continuous downward trend, expected to continue as investors turn away until the economy signals recovery of the global oil industry. In conclusion, macroeconomic conditions, exchange rate instability, and stock market projections deem the portfolio prospects as negligible and even dire.

Endnotes

IMF Report 2020: IMF Executive Board Approves US$ 3.4 Billion in Emergency Support to Nigeria to Address the COVID-19 Pandemic

https://nairametrics.com/wp-content/uploads/2020/05/IMF-report.pdf

Nigeria National Bureau of Statistics

https://www.nigerianstat.gov.ng/

Kev Del Castillo is an Arrupe Fellow and Development Economist specializing in SSA and International Development